Unlocking Automation Efficiency: E-Commerce Payment Reconciliation Savior of Your Online Business

In the bustling world of e-commerce, where transactions occur at lightning speed and across multiple platforms, managing finances can quickly become a nightmare. Sellers often find themselves grappling with discrepancies between their records and those of their marketplace partners, leading to significant losses. In this blog post, we’ll explore the critical role of e-commerce payment reconciliation, how it can prevent financial leaks, and how Revalsys’s automated tool can streamline the entire process.

Understanding the Financial Pitfalls for E-Commerce Sellers

E-commerce sellers face a plethora of challenges, but one of the most critical is ensuring that every transaction is accurately accounted for. Discrepancies between marketplace reports and a seller’s own records can lead to lost revenue, unclaimed credits, and even potential conflicts with marketplace partners. These discrepancies often arise due to errors in data entry, delays in reporting, or differences in transaction recording.

What is E-Commerce Payment Reconciliation?

E-commerce payment reconciliation is the process of matching the payments received from marketplaces with the records of sales transactions recorded by the seller. This involves comparing transaction data from multiple sources, identifying discrepancies, and resolving them to ensure that financial records are accurate and complete. Effective reconciliation helps in maintaining financial integrity and avoiding potential losses.

Features and Benefits of E-Commerce Payment Reconciliation

1. Data Collection: E-commerce payment reconciliation tool automates the process of collecting data from multiple marketplaces. This removes the need for manual data entry and guarantees that all relevant information is captured instantly.

2. Discrepancy Detection: The e-commerce payment reconciliation tool automatically identifies discrepancies between the seller’s records and the marketplace reports. This helps sellers quickly address any issues and avoid financial losses.

3. Time Efficiency: With just a few clicks, sellers can reconcile their transactions and generate detailed reports. Revalsys E-commerce payment reconciliation saves valuable time and allows sellers to focus on other critical aspects of their business.

4. Enhanced Accuracy: By automating the e-commerce reconciliation process, sellers can achieve greater accuracy in their financial records. This reduces the risk of errors and ensures that all transactions are properly accounted for.

5. Comprehensive Reporting: The tool provides detailed reports that highlight discrepancies and offer insights into payment trends. This helps sellers make informed decisions and optimize their financial strategies.

The Process of E-Commerce Payment Reconciliation Through Automation

1. Automatic Data Collection

The e-commerce payment reconciliation tool automatically collects transaction data from various marketplaces, including payment amounts, fees, and refunds. This removes the need for manual data entry and guarantees that all relevant information is captured instantly.

2. Data Matching and Normalization

Once the data is collected, the tool matches and normalizes it against the seller’s internal records. This step ensures consistency in data formats and structures, making it easier to compare and analyze transactions across different marketplaces.

3. Validation & Verification

The tool validates and verifies the data to ensure its accuracy and completeness. Any inconsistencies or anomalies are flagged for further review, ensuring that the reconciliation process is based on reliable information.

4. Reconciliation & Identify Discrepancies

The tool performs the reconciliation process by comparing the validated data against the seller’s records.It automatically identifies any discrepancies, such as mismatches in payment amounts, fees, or refunds, and provides detailed reports on the nature and extent of these issues.

5. Reporting

Finally, the tool generates comprehensive reports that highlight the identified discrepancies, along with insights into payment trends. These reports empower sellers to make data-driven decisions, resolve issues promptly, and maintain accurate financial records.

Who Can Benefit from E-Commerce Payment Reconciliation?

- Suitable for all types of sellers, whether you’re a small business or a large enterprise. E-commerce payment reconciliation adapts to your specific needs.

- Ideal for sellers operating across multiple marketplaces. It simplifies the complexities of managing payments on various platforms.

- Particularly beneficial for those handling high transaction volumes. An automated tool efficiently manages large amounts of data.

- Effective for managing complex payment structures. It ensures accuracy and clarity in tracking various payment methods.

- Helps sellers who frequently deal with refunds and chargebacks. The tool quickly identifies and resolves discrepancies.

- Simplifies tracking and resolving payment discrepancies. Automated reconciliation reduces the chances of errors and inconsistencies.

- Reduces manual effort and minimizes errors in financial reconciliation. Sellers can focus on growth instead of manual accounting tasks.

- Enhances financial transparency and accuracy. It provides clear, real-time reports on payment statuses by e-commerce payment reconciliation.

- Saves time by automating the reconciliation process. What once took hours can now be done in minutes with greater precision.

- Provides real-time insights into payment status across platforms. Sellers gain a complete view of their financial operations in one place.

The Consequences of Neglecting Reconciliation

Without a proper e-commerce payment reconciliation process, sellers may face several challenges, including:

1. Financial Losses: Unresolved discrepancies can lead to significant financial losses.

2. Operational Inefficiencies: Manual reconciliation is time-consuming and prone to errors.

3. Inaccurate Financial Records: Inaccurate records can impact financial reporting and decision-making.

4. Delayed Payments: Unreconciled transactions can result in delays in receiving payments from marketplaces.

5. Compliance Issues: Inaccurate financial records can lead to non-compliance with regulatory requirements, risking penalties.

6 .Damaged Reputation: Consistent financial discrepancies can harm your business’s credibility and relationships with partners and customers.

How Revalsys Marketplace E-Commerce Payment Reconciliation Can Help

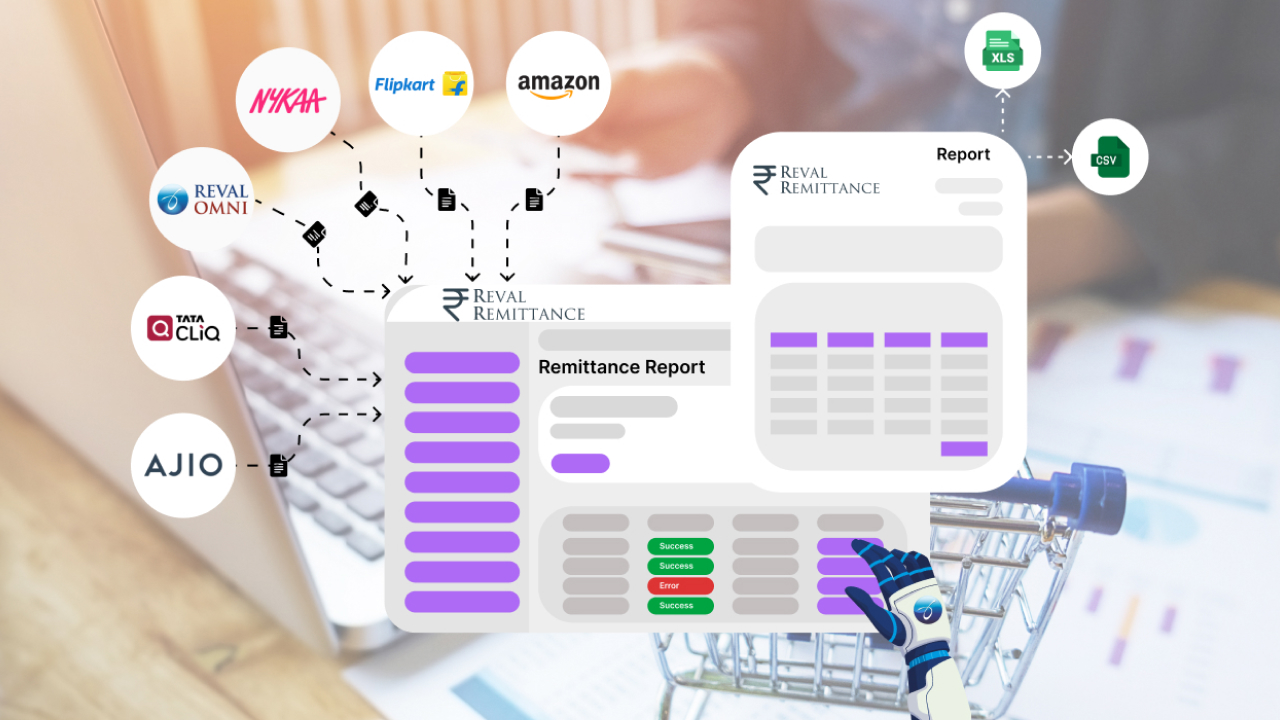

Revalsys’s marketplace e-commerce payment reconciliation tool offers a range of features designed to address key financial management challenges. From automating data collection to enhancing accuracy and efficiency, discover how our solution can transform your reconciliation process.

1. Comprehensive Solution

Revalsys’s e-commerce marketplace payment reconciliation tool offers a complete solution for managing payment discrepancies. It covers all marketplaces, streamlining the reconciliation process.

2. Automated Data Collection

Automatically collects data from various platforms, reducing manual entry. This removes the necessity for manual data entry and minimizes the risk of human errors.

3. Efficient Discrepancy Detection

Detects and flags discrepancies in transactions swiftly. Ensures timely resolution of financial inconsistencies.

4. Accurate Financial Records

Maintains precise financial records, reducing the risk of errors. Supports reliable and consistent financial reporting.

5. Time-Saving Automation

Automates the reconciliation process, freeing up valuable time. Lowers manual effort and speeds up the entire process.

6. Enhanced Accuracy

Improves financial reporting accuracy, leading to better decision-making. Ensures reliable data for strategic planning.

7. Optimized Financial Strategies

Provides clear, reliable data to help sellers refine their financial strategies. Supports more informed business decisions.

Conclusion

E-commerce payment reconciliation is a crucial process for managing financial accuracy and operational efficiency in the e-commerce sector. By leveraging automation tools like Revalsys’s ecommerce marketplace payment reconciliation solution, sellers can effectively manage payment discrepancies, reduce financial losses, and focus on growing their business. Embracing automation in payment reconciliation is not just a technological advancement—it’s a strategic move towards more efficient and profitable e-commerce operations.

FAQ

1. What is e-commerce payment reconciliation?

E-commerce payment reconciliation is the process of matching payments received from marketplaces with the seller’s own sales records. It involves comparing transaction data from various sources, identifying discrepancies, and resolving them to ensure accurate financial records.

2. Why is e-commerce payment reconciliation important for sellers?

E-commerce payment reconciliation is crucial for preventing financial discrepancies, managing high transaction volumes, and maintaining accurate financial records. It helps avoid losses, resolve conflicts with marketplace partners, and ensure compliance with financial regulations.

3. How does Revalsys’s tool automate data collection?

Revalsys’s tool automatically collects transaction data from multiple marketplaces, including payment amounts, fees, and refunds. This automation eliminates the need for manual data entry, reducing errors and ensuring up-to-date information.

4. What types of discrepancies can the tool detect?

The tool can detect various discrepancies such as mismatches in payment amounts, fees, refunds, or chargebacks. It identifies inconsistencies between the seller’s records and marketplace reports, helping address issues promptly.

5. How does the tool enhance time efficiency?

By automating the reconciliation process, the tool allows sellers to reconcile transactions and generate reports with just a few clicks. This time-saving automation accelerates the process and frees up time for other critical business tasks.

6. Who can benefit from using an e-commerce payment reconciliation tool?

The tool benefits all types of sellers, from small businesses to large enterprises, especially those operating across multiple marketplaces or dealing with high transaction volumes. It’s also valuable for managing complex payment structures and frequent refunds or chargebacks.

7. What are the potential consequences of neglecting payment reconciliation?

Neglecting payment reconciliation can lead to significant financial losses, operational inefficiencies, inaccurate financial records, delayed payments, compliance issues, and damage to your business reputation. Proper reconciliation is essential to avoid these challenges and maintain financial integrity.