RoDTEP Explained: Benefits and Transformation for Indian Exporters

In recent years, the Indian government has rolled out several measures to enhance the competitiveness of Indian exports, and the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme is one of the most significant. Imagine this: every time exporter ships goods abroad, they incur several hidden costs due to taxes and duties on inputs like raw materials, fuel, and services. RoDTEP steps in to alleviate this burden by offering refunds on these indirect taxes, ensuring that exporters no longer have to bear these costs. This allows Indian businesses to lower their overall production expenses and offer more competitive prices in the international market. By making exports more affordable, RoDTEP creates new opportunities for growth and expansion in global trade.

What does this mean for Indian exporters? The benefits are far-reaching. First, RoDTEP helps businesses—especially small and medium-sized enterprises (SMEs)—cut down on costs, making it easier for them to compete with global players. This, in turn, could lead to more Indian products being shipped across the world, from textiles and handicrafts to chemicals and machinery. Not only does this support job creation and boost the economy, but it also encourages innovation and better product quality. RoDTEP is more than just a refund system; it’s a transformative initiative that’s setting India’s export sector on a path to greater global competitiveness. With more savings, exporters can reinvest in their operations, explore new markets, and contribute to India’s ambition of becoming a trillion dollars economy.

In this blog, we will explore how RoDTEP is transforming Indian exports, its key benefits, and its long-term impacts on the country’s trade landscape.

What is RoDTEP?

RoDTEP is a new export scheme introduced by the Government of India to replace the earlier Merchandise Exports from India Scheme (MEIS). While MEIS provided duty benefits to exporters, RoDTEP aims to offer a more transparent and efficient way to reimburse indirect taxes and duties incurred by exporters on goods and services.

This includes refunds on taxes such as GST (Goods and Services Tax) paid on inputs, fuel, and other duties that increase the cost of exporting goods. RoDTEP covers a wide range of export goods, from agricultural products to industrial items, making it applicable to a diverse group of exporters.

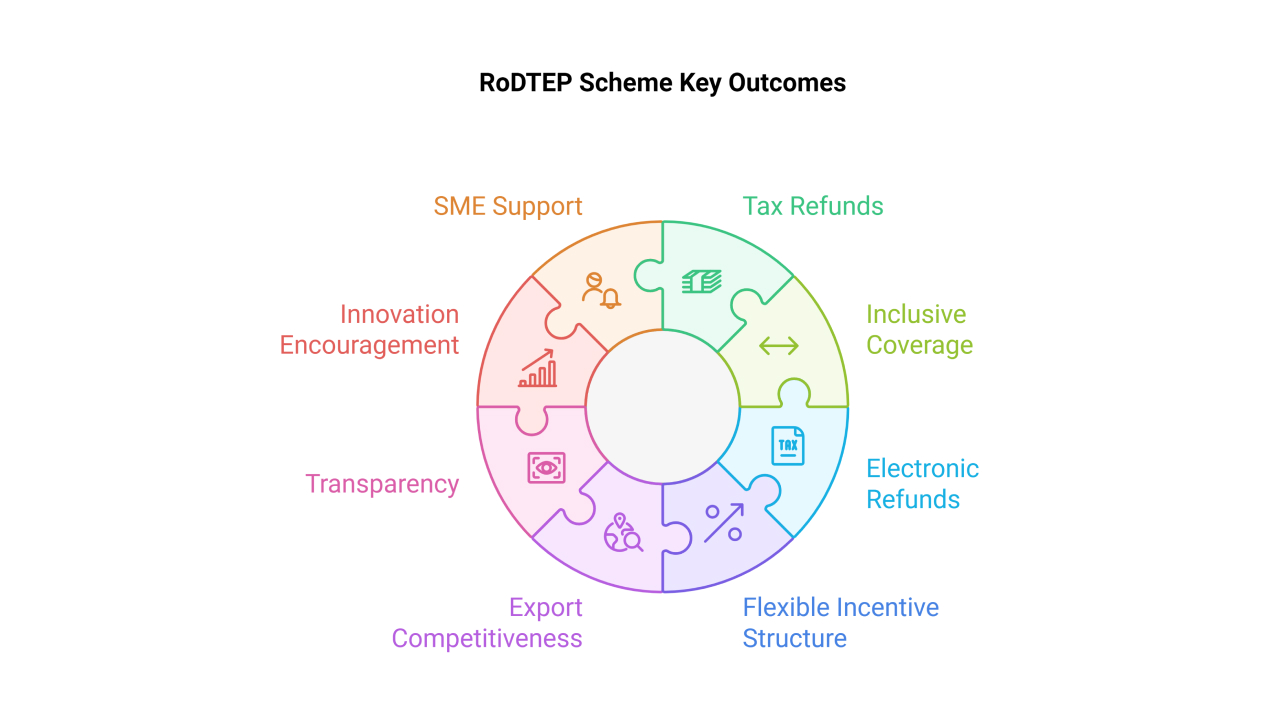

Key Features of RoDTEP: What Makes It a Game-Changer for Indian Exports?

1. Refund of Taxes and Duties: Saving Costs, Boosting Competitiveness

One of the primary objectives of the RoDTEP scheme is to refund indirect taxes and duties that have been embedded in the cost of exported products. These taxes, which are often overlooked by other export incentive schemes, include central taxes like GST on inputs, state taxes, and local taxes. The taxes that are refunded under RoDTEP include those paid on raw materials, fuel, packaging materials, and various services used in the manufacturing process. By refunding these taxes, RoDTEP reduces the overall cost of production for exporters, enabling them to offer more competitive pricing on international markets and thereby boosting India’s export potential.

2. Inclusive Coverage: A Scheme for Every Exporter

Unlike previous export incentive schemes, RoDTEP is designed to cover a wide range of export goods and services. This makes it a more inclusive scheme, benefiting a broad spectrum of industries from agriculture to textiles, engineering products, and even high-tech sectors. While earlier programs like the MEIS (Merchandise Exports from India Scheme) had a limited focus on specific categories, RoDTEP aims to support all eligible exporters by refunding taxes on their exported products, irrespective of the sector they belong to. This broader coverage ensures that a greater number of businesses, including those in the SME (Small and Medium Enterprise) sector, can take advantage of the scheme.

3. Say Goodbye to Paperwork: Welcome to Electronic Refunds

RoDTEP has been designed to make the refund process smooth, transparent, and hassle-free for exporters. The scheme operates in a completely digital and automated manner, meaning exporters can easily apply for refunds online without the need for complicated paperwork or bureaucratic delays. The entire process, from application to refund, is handled electronically, ensuring that exporters receive their refunds quickly and efficiently. This reduces the administrative burden on businesses, saving them time and effort. The system also provides real-time tracking of refund claims, offering a level of transparency that was not available in earlier schemes.

4. Flexible Incentive Structure: More Refunds, More Benefits

The refund amount under RoDTEP is provided as a percentage of the FOB (Free On Board) value of the export shipment. This percentage varies depending on the category of the exported product. For instance, different goods, like agricultural products or manufactured goods, may qualify for different refund rates based on their input costs and overall contribution to exports. This flexible incentive structure ensures that refunds are aligned with the actual cost structure of the products being exported, creating a fair and transparent mechanism for all exporters. The refund is credited directly to the exporter’s bank account, streamlining the process and ensuring that the benefits reach exporters without unnecessary delays.

5. Enhancing Export Competitiveness: Winning the Global Race

RoDTEP not only aims to provide financial relief but also focuses on improving the competitiveness of Indian products in international markets. By refunding embedded taxes and duties, the scheme helps reduce the overall production cost, which in turn enhances the affordability of Indian goods globally. This makes Indian exports more competitive against countries with lower manufacturing costs. By improving cost-effectiveness, RoDTEP enables Indian exporters to better position their products in the global market, thereby helping them expand their reach and gain a larger share of international trade.

6. A Transparent and Accountable System: Clarity at Every Step

The RoDTEP system is designed to be transparent, ensuring that exporters are fully aware of the benefits they are entitled to. The scheme uses a technology-driven approach that provides real-time data and tracking of refund claims, making it easier for exporters to monitor the status of their claims. This level of transparency fosters trust in the system and ensures that the refunds are provided in a fair and accountable manner. The digital platform also ensures that there is no room for delays or corruption, further enhancing the scheme’s credibility and effectiveness.

7. Encouragement for Innovation and Quality Improvement

One of the key benefits of RoDTEP is that it incentivizes exporters to innovate and improve the quality of their products. With the financial relief provided by refunds, businesses can reinvest the savings into upgrading their manufacturing processes, adopting new technologies, or improving product quality. This, in turn, allows exporters to meet the growing demands for better quality, sustainable products, and advanced technologies in global markets. As Indian products become known for their superior quality, it will lead to stronger brand recognition and open doors to new export opportunities in higher-value markets.

8. Support for Small and Medium Enterprises (SMEs)

SMEs often face significant challenges when it comes to competing in the global market. High production costs, limited access to financing, and complex regulatory frameworks can make it difficult for small businesses to thrive. RoDTEP plays a critical role in addressing these challenges by providing financial relief through the refund of taxes and duties. This allows SMEs to lower their production costs and improve their pricing competitiveness, making it easier for them to expand their reach internationally. Additionally, the simplicity of the electronic refund system makes it easier for small businesses, which may not have dedicated teams for paperwork, to participate in the scheme.

9. Supporting Sustainability: Exporting with a Conscience

As global markets increasingly demand products that adhere to environmental and sustainability standards, RoDTEP is encouraging Indian exporters to adopt green and sustainable practices. The reduction in costs through tax refunds allows businesses to allocate more resources toward sustainable manufacturing practices, such as using eco-friendly raw materials, adopting energy-efficient technologies, and reducing carbon emissions. By aligning with global sustainability standards, Indian exporters can gain access to markets that prioritize environmental responsibility and promote India as a hub for eco-conscious exports.

10. Long-Term Economic Impact: A Better Future for Indian Exports

RoDTEP’s long-term benefits extend beyond just the export sector. By supporting the growth of exports, RoDTEP contributes directly to India’s GDP growth and strengthens its position in global trade. As exporters grow and increase their sales abroad, they create more jobs, generate higher revenues, and contribute to a positive trade balance. This, in turn, helps improve India’s foreign exchange reserves and enhances its global economic standing. Furthermore, as more sectors benefit from the scheme, India’s overall industrial and export capacity is likely to expand, positioning the country as a key player in international markets.

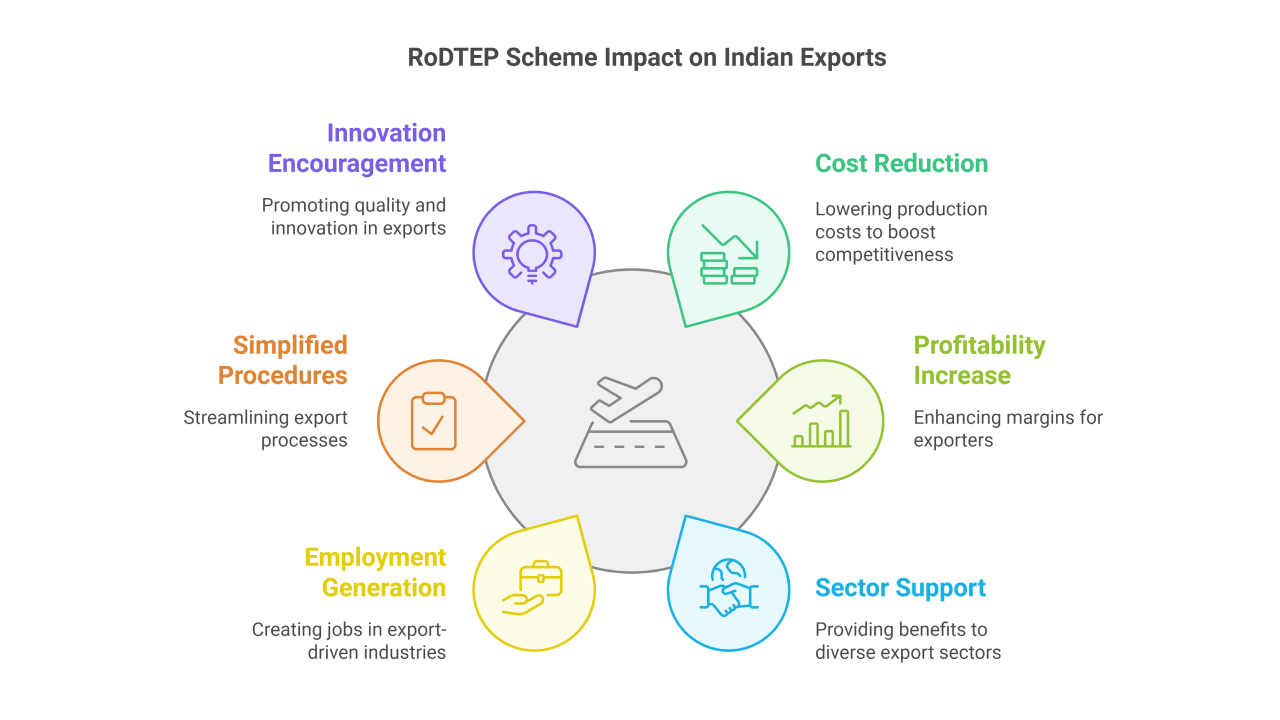

How RoDTEP is Impacting Indian Exports

The introduction of RoDTEP is expected to have a far-reaching impact on India’s export sector, especially in the context of a competitive global market. Let’s look at the major ways it is transforming the export landscape.

1. Boost to Export Competitiveness

India faces intense competition in the global market from countries like China, Vietnam, and Thailand. These countries have lower manufacturing costs, and some of them enjoy export incentives similar to those offered by India under RoDTEP. By refunding embedded taxes, RoDTEP helps bring down the overall cost of exports, making Indian products more competitive internationally.

This reduction in cost can be particularly helpful for small and medium-sized enterprises (SMEs), which often struggle to compete due to high production and operational costs. With RoDTEP, these businesses now have a fighting chance to expand their reach globally and contribute to India’s export growth.

2. Increased Profitability for Exporters

Exporters often face challenges related to high production costs and duties that eat into their margins. By refunding the duties and taxes they pay, RoDTEP directly impacts the profitability of exporters. For industries with thin profit margins, this financial relief can be a game-changer, allowing them to reinvest the savings into improving their products or expanding their market reach.

In addition, exporters no longer need to bear the full brunt of indirect taxes like GST on inputs, which were previously an additional financial burden. With more money in their pockets, businesses can focus on scaling up operations and entering new markets.

3. Support for New Export Sectors

RoDTEP is designed to support a variety of sectors, including agriculture, handicrafts, textiles, chemicals, and engineering products. One of the key aspects of the scheme is its inclusivity, providing benefits across sectors that were previously excluded from similar benefits.

For example, the agricultural sector, which is a vital component of India’s economy, has long faced challenges in accessing export incentives. RoDTEP provides much-needed support to agricultural exporters, encouraging them to increase production and meet the growing demand for Indian agricultural products in international markets.

Similarly, the textile and handicraft sectors, which are major contributors to India’s export economy, stand to gain from the scheme, allowing them to compete with countries like Bangladesh and China in the global textile market.

4. Boost to Employment Generation

Exports play a key role in employment generation, particularly in sectors like textiles, handicrafts, and manufacturing. By making exports more attractive through the RoDTEP scheme, India can expect to see an increase in demand for products, which will, in turn, lead to higher production levels and job creation.

With RoDTEP, companies are incentivized to expand their operations, which could lead to the creation of more jobs, particularly in manufacturing and agriculture. This will help address the issue of unemployment and improve livelihoods for workers in export-driven industries.

5. Simplified Export Procedures

One of the biggest challenges faced by exporters is the complexity of government procedures. Before RoDTEP, exporters had to navigate a maze of complicated systems to avail benefits under schemes like MEIS. With RoDTEP, the process has been simplified through automation and digitization.

Exporters can now easily apply for refunds through a simplified and transparent system. This cuts down on the time and effort spent on paperwork and ensures faster processing of claims. The use of technology has made the process more efficient, reducing delays and ensuring that exporters get the benefits they deserve without unnecessary hindrances.

6. Encouragement for Innovation and Quality Improvement

RoDTEP does not only help reduce costs; it also incentivizes exporters to innovate and improve the quality of their products. With the financial support provided through refunds, exporters have more resources to invest in upgrading their manufacturing processes, adopting new technologies, and improving the quality of their goods.

In addition, exporters will be better positioned to meet the growing demands of international markets, which increasingly prioritize quality, sustainability, and innovation. This encouragement to raise standards can help Indian exporters establish a strong reputation globally and gain access to higher-value markets.

Challenges and Way Forward

While RoDTEP brings significant advantages, there are still some challenges that need to be addressed for the scheme to realize its full potential. For instance, the exact structure of the refund percentages for each category of products is still being worked out, which creates some uncertainty among exporters.

Additionally, there is the challenge of ensuring that all exporters, especially small businesses, are able to understand and navigate the new system. While the automation of refunds is a step in the right direction, there needs to be adequate support and guidance to help exporters take full advantage of the scheme.

The government must also ensure timely disbursal of refunds and make the process even more transparent to avoid delays and complications.

How Revalsys RoDTEP Automation Solutions Help Businesses Overcome Challenges

Revalsys RoDTEP Automation Solutions provide businesses with a seamless, end-to-end platform to manage their RoDTEP claims effectively. The solution automatically collects and organizes data from multiple sources, calculates refund amounts with accuracy, and ensures compliance with government guidelines. Its intuitive interface simplifies the process for SMEs and large enterprises alike, reducing manual effort and human error. Additionally, it offers real-time tracking of refund statuses, empowering businesses to plan better and eliminate uncertainties associated with the refund process.

Conclusion

RoDTEP is a game-changing initiative for Indian exports. By reducing the financial burden on exporters, promoting competitiveness, and supporting a wide range of sectors, the scheme is set to drive India’s export growth and strengthen its position in the global market.

In the long term, RoDTEP will not only make Indian products more attractive to international buyers but will also encourage innovation, quality improvement, and job creation. For India, this is a crucial step toward achieving the ambitious target of becoming a trillion dollars economy and further integrating into the global trade ecosystem.

As the scheme continues to evolve and more exporters take advantage of it, the positive impact on India’s export performance is likely to be substantial, making RoDTEP an essential pillar of India’s economic growth and export success in the coming years.