Automate Your Indian Payroll: A Practical Guide to AI-Powered Software for 2025

Payroll is the lifeline of any organization. For Indian businesses—whether startups, SMEs, or large enterprises—payroll is more than just salary disbursement. It involves compliance with dynamic tax laws, provident fund contributions, professional tax, gratuity, reimbursements, and a host of statutory requirements. Managing these processes manually is not only time-consuming but also risky, given the consequences of errors and delays.

As we step into 2025, Artificial Intelligence (AI) is transforming payroll management in India. AI-powered payroll software is no longer a luxury—it has become a necessity for organizations aiming to improve accuracy, save time, enhance compliance, and deliver a seamless employee experience.

This practical guide explores how Indian businesses can automate payroll with AI-driven solutions, the benefits they bring, how to implement them, and what to expect in the future of payroll.

Why Indian Payroll Needs Automation

Before diving into AI, it’s important to understand why payroll automation is critical in the Indian context. Payroll in India is uniquely complex due to:

- Frequent Statutory Updates: In India, payroll compliance rules such as income tax, provident fund, and professional tax change frequently. Manually tracking these updates often leads to mistakes and missed deadlines. Automation ensures businesses stay compliant without the risk of errors.

- Multi-State Compliance: Companies operating in multiple states must deal with different labour laws, minimum wage rules, and professional tax structures. Managing these manually becomes complex and time-consuming. Payroll automation helps standardize and adapt processes across regions.

- Multiple Salary Components: Indian payroll structures include basic pay, HRA, LTA, conveyance, allowances, and deductions, each with unique tax implications. Calculating these manually is prone to mistakes. Automated payroll software applies accurate rules to each component with ease.

- Employee Diversity: Workforces today include full-time staff, freelancers, contractors, and gig workers, all requiring different payroll approaches. Manual handling of such diversity is error-prone. AI-powered payroll systems simplify management by tailoring processes for each type.

- High Error Costs: Mistakes like wrong salary credits, delayed payments, or tax miscalculations can frustrate employees and damage trust. They also invite penalties and compliance issues. Payroll automation minimizes these risks by ensuring precision and timeliness.

What is Payroll?

Indian payroll encompasses the processes of calculating, disbursing, and recording employee salaries, while ensuring compliance with statutory regulations such as Employees’ Provident Fund (EPF), Employees’ State Insurance (ESI), Tax Deducted at Source (TDS), and Professional Tax (PT). It also involves managing bonuses, overtime, leave adjustments, and other variable components. With India’s workforce exceeding hundreds of millions and spanning formal, informal, and gig sectors, payroll systems must be robust, adaptable, and compliant to meet diverse needs.

Payroll in India is unique due to its regulatory complexity and regional variations. For instance, Professional Tax rates differ across states, while EPF and ESI have specific eligibility criteria based on employee count and wage thresholds. In 2025, the push for digital compliance through government portals like Shram Suvidha and the adoption of trends like earned wage access (EWA) are reshaping payroll operations, making accuracy and agility paramount.

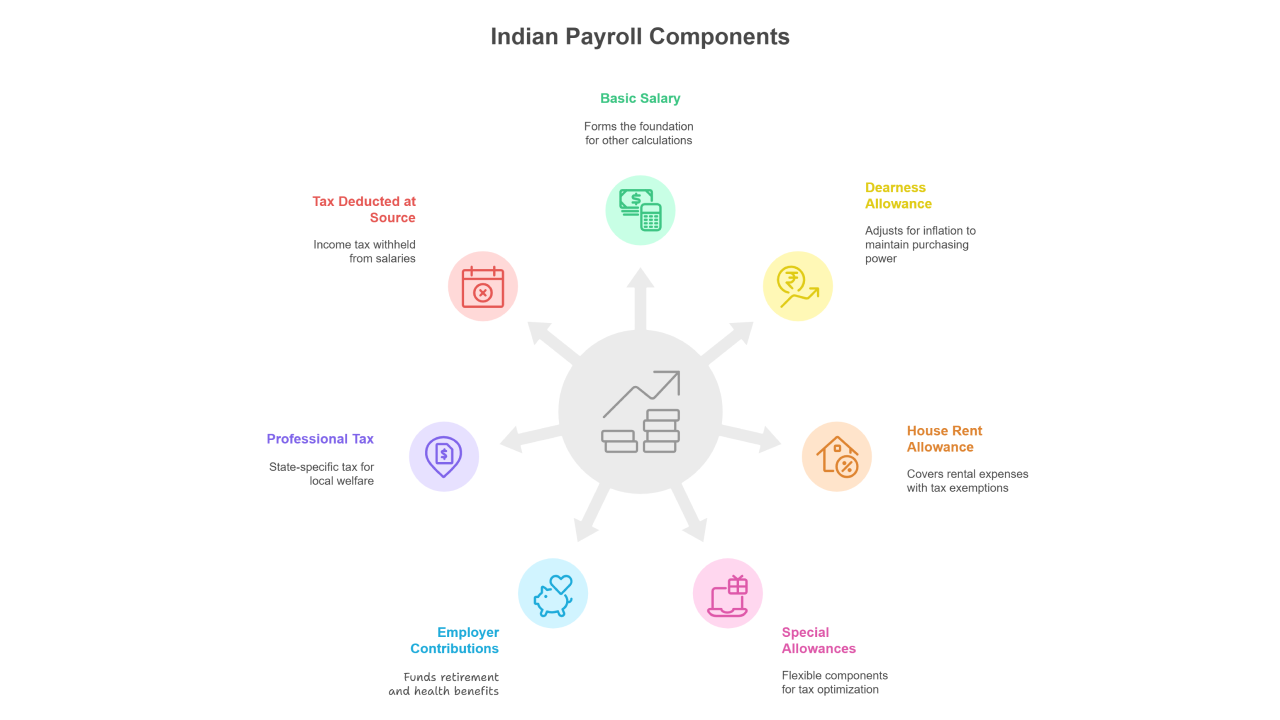

Key Components of Indian Payroll

To understand the challenges, it’s essential to grasp the core elements of Indian payroll, which form the backbone of compliance and employee satisfaction:

1. Basic Salary

The foundational component of an employee’s pay, typically 40-50% of the Cost to Company (CTC). It forms the basis for calculating other elements like EPF contributions and gratuity.

2. Dearness Allowance (DA)

A cost-of-living adjustment to offset inflation, often mandatory for public sector employees and optional for private firms. DA is linked to the Consumer Price Index and varies regionally, helping employees maintain purchasing power.

3. House Rent Allowance (HRA)

A tax-exempt allowance (up to certain limits) to cover rental expenses, especially relevant in urban centers like Mumbai or Delhi. HRA depends on salary, rent paid, and city type (metro or non-metro), with exemptions calculated under Section 10(13A) of the Income Tax Act.

4. Special Allowances

Flexible components like travel, meal, or performance-based allowances, used to optimize tax liability or incentivize employees. These vary by company policy and are often taxable unless specifically exempt.

5. Employer Contributions to PF and ESI

EPF requires employers to contribute 12% of basic salary plus DA (subject to a wage ceiling) to employees’ retirement funds, matched by employee contributions. ESI mandates employer contributions (3.25%) for employees earning below a wage threshold, funding health and social benefits.

6. Professional Tax (PT)

A state-specific tax deducted from employee salaries to fund local welfare programs. PT rates vary across regions and income levels, requiring precise calculations and timely remittances to state authorities.

7. Tax Deducted at Source (TDS)

Income tax withheld from salaries based on income slabs, requiring accurate calculations and quarterly filings (Form 24Q) to avoid penalties.

These components demand meticulous calculations, timely remittances, and audit-ready records. Non-compliance risks financial penalties and reputational damage, making automation a growing necessity. For deeper insights, explore our payroll compliance checklist.

Why payroll in India is complex

Indian payroll management involves navigating an intricate web of constantly evolving labour laws, including the Payment of Wages Act, Minimum Wages Act, and Employees’ Provident Fund Act. Consequently, even experienced payroll professionals struggle to keep pace with regulatory changes. For businesses operating across multiple states, the challenge intensifies as tax regulations and minimum wage rates differ by location.

The diversity of employment arrangements further complicates matters. Companies must correctly classify employees as permanent, temporary, or contractors, as misclassification impacts tax liabilities and benefits eligibility. Additionally, calculating overtime presents unique challenges, as rates can vary based on whether work is performed during the day, night, weekday, or holiday.

What is AI-Powered Payroll Software?

AI-powered payroll software is the next step in payroll management, going far beyond standard automation. While traditional payroll tools simply calculate salaries and generate payslips, AI-driven systems are intelligent—they learn from payroll data, identify trends, and optimize processes over time. This makes payroll smarter, more efficient, and highly adaptable to complex business needs.

Some of the key AI capabilities include:

Smart Compliance Monitoring: In India, tax laws and labor regulations change frequently, making compliance difficult to manage manually. AI systems automatically track these updates and apply them to payroll rules, ensuring organizations stay compliant without extra effort.

Error Detection & Prevention: Payroll mistakes—such as duplicate entries, incorrect overtime, or missed deductions—can be costly. AI algorithms identify anomalies in real time and flag them before they affect salary processing, reducing risks and penalties.

Predictive Insights: Beyond just processing payroll, AI offers strategic insights. It can forecast payroll expenses, help HR teams with workforce budgeting, and even show the financial impact of new hires, bonuses, or policy changes.

Natural Language Processing (NLP): Employees often raise queries about payslips, deductions, or reimbursements. AI-powered chatbots use NLP to instantly answer these questions, reducing the workload on HR teams and improving employee satisfaction.

Integration with HR & Finance Systems: Payroll does not work in isolation—it is closely linked with attendance, performance, and accounting systems. AI-powered payroll software integrates seamlessly with these platforms, creating a single source of truth for all employee and financial data.

Benefits of Automating Payroll with AI

1. Unmatched Accuracy: AI eliminates manual errors, ensuring salaries, taxes, and deductions are calculated correctly every time.

2. Time Savings: Payroll cycles that once took days can be completed in hours, freeing HR teams to focus on strategic tasks.

3. Compliance Assurance: AI keeps pace with India’s ever-changing tax and labor regulations, automatically applying updates.

4. Cost Efficiency: Automation reduces dependency on large payroll teams, minimizing administrative overheads.

5. Improved Employee Experience: Employees can access payslips, tax reports, and reimbursement claims instantly via mobile apps or chatbots.

6. Scalability: Whether you’re a 20-member startup or a 5,000-employee enterprise, AI payroll systems scale with your workforce.

7. Fraud Prevention: AI systems flag suspicious activities such as ghost employees, duplicate salary accounts, or unusual bonus patterns.

Key Features of AI-Powered Payroll Software for Indian Businesses

When choosing payroll software in 2025, here are the must-have features:

- Automated Salary Processing: Handles all salary structures, allowances, and deductions.

- Statutory Compliance Engine: Updates with changes in TDS, PF, ESI, gratuity, and professional tax laws.

- Self-Service Portals: Employees access payslips, tax forms, and claim reimbursements independently.

- Leave & Attendance Integration: Automatic syncing with biometric or app-based attendance systems.

- Multi-Currency & Multi-State Support: Essential for organizations with distributed teams.

- AI Chatbots: Resolve employee queries instantly.

- Analytics & Reports: Provide insights into salary trends, compliance risks, and workforce costs.

- Mobile Accessibility: Process payroll and approve requests from anywhere.

- Data Security: End-to-end encryption, two-factor authentication, and role-based access.

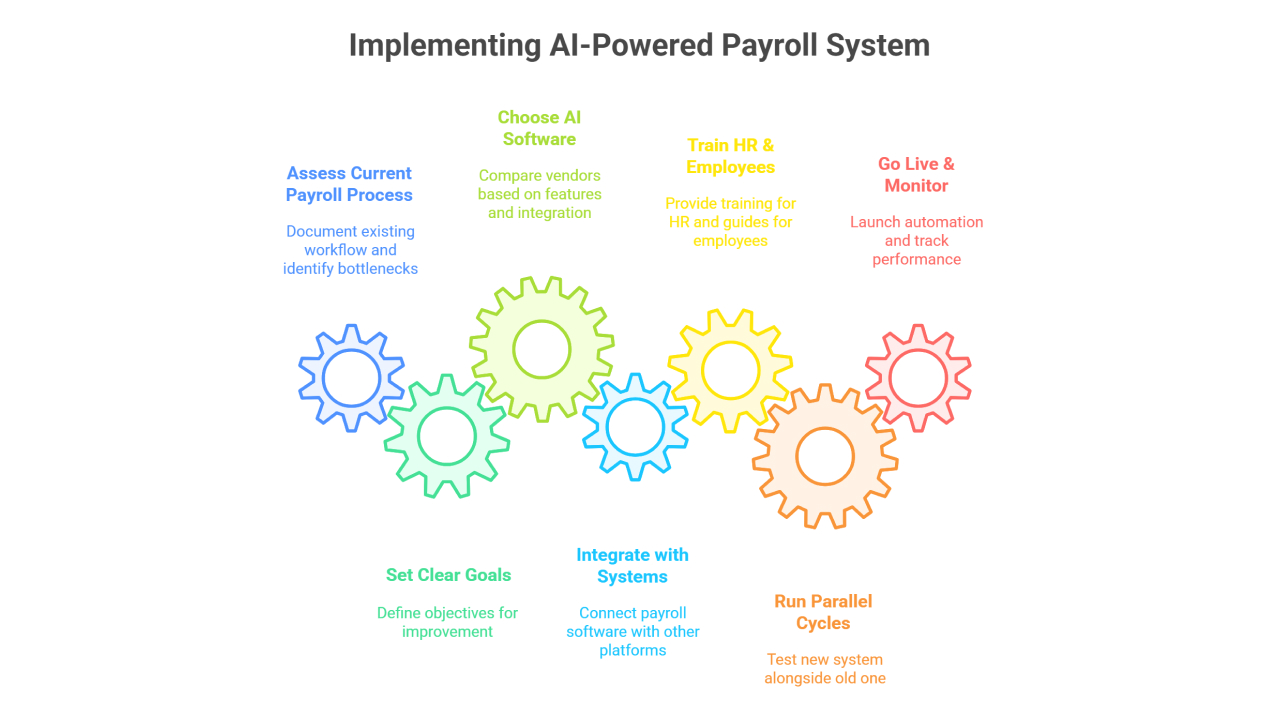

Practical Steps to Automate Payroll in 2025

Step 1: Assess Your Current Payroll Process

Document your existing payroll workflow—data collection, approvals, compliance, and disbursement. Identify bottlenecks and pain points.

Step 2: Set Clear Goals

Decide what you want to achieve: faster processing, better compliance, cost reduction, or enhanced employee experience.

Step 3: Choose the Right AI-Powered Payroll Software

Compare vendors based on features, ease of use, integration with your HRMS/ERP, compliance updates, and pricing.

Step 4: Integrate with Existing Systems

Seamlessly connect payroll software with attendance, HR, and finance platforms for data accuracy.

Step 5: Train HR & Employees

Provide workshops for HR staff and simple guides for employees to use self-service portals.

Step 6: Run Parallel Payroll Cycles

Before going live, run the new system alongside your old one for a couple of months to identify discrepancies.

Step 7: Go Live & Monitor

Launch payroll automation, track performance, and use AI analytics to continuously improve processes.

Payroll Trends in India for 2025

AI payroll automation is part of a bigger HR transformation in India. Here are some trends shaping payroll this year:

- Hyper-Automation: Combining AI, machine learning, and RPA (Robotic Process Automation) for end-to-end payroll workflows.

- Cloud-Native Payroll: SaaS-based payroll systems offering flexibility and scalability.

- Employee-Centric Payroll: More personalized salary structures and on-demand pay (advance salary access).

- AI-Powered Analytics: Predicting workforce costs, attrition risk, and compensation benchmarking.

- Integration with Fintech: Linking payroll with digital wallets, UPI, and instant tax filing tools.

- Payroll Outsourcing with AI: Hybrid models where service providers use AI software to manage payroll for businesses.

- Fully Autonomous Payroll: AI will manage payroll with minimal human intervention.

- Voice-Activated Payroll Commands: HR leaders could process payroll using voice assistants.

- Blockchain Integration: Ensuring transparent, tamper-proof payroll transactions.

- AI-Driven Tax Advisory: Personalized tax-saving recommendations for employees.

- Global Payroll Harmonization: Indian companies with global operations will manage payroll on unified platforms.

Choosing the Right Payroll Vendor in India

When selecting AI payroll software for 2025, consider:

- Compliance Strength: Ensure vendor provides timely updates for Indian tax laws.

- Customization: Ability to handle unique salary structures and allowances.

- Integration Capability: Must integrate with HRMS, ERP, and attendance systems.

- Customer Support: 24/7 support with regional language assistance.

- Pricing Models: Choose between subscription-based SaaS or one-time licensing.

- Reputation & Security: Vendor’s track record in data security and reliability.

Final Thoughts

For Indian businesses, payroll is no longer a back-office function it is a strategic enabler of employee trust, compliance, and financial planning. AI-powered payroll software offers the perfect solution to overcome India’s complex payroll landscape in 2025.

By automating payroll, businesses can achieve:

- Faster, error-free salary disbursements

- Zero compliance risks

- Higher employee satisfaction

- Cost efficiency and scalability

The future belongs to organizations that embrace AI in payroll and HR. If you’re still relying on manual spreadsheets or outdated software, now is the time to switch. Automate your Indian payroll with AI—and step into a smarter, more efficient 2025.